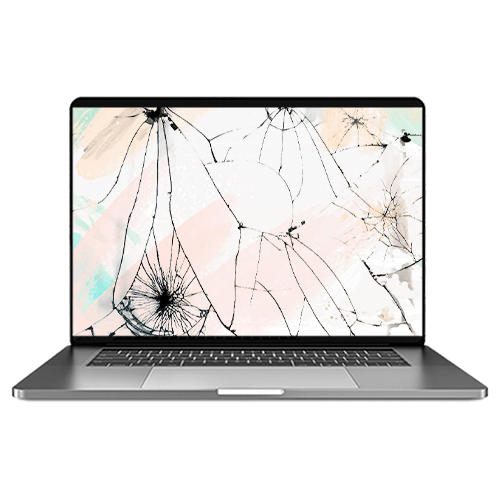

Display Device Damage

05.09.2023Matt Morelli

According to a study conducted by the market research firm Dimensional Research, 70% of businesses report experiencing loss or damage to their display devices, such as monitors, TVs, and projectors. This is a significant issue, as these devices are often expensive and essential to the operation of many businesses.

The reasons for this loss or damage can vary. In some cases, the devices may be damaged by accidents or natural disasters, such as fires, floods, or earthquakes. In other cases, the devices may be stolen or vandalized.

The frequency of loss or damage to display devices can also vary depending on the type of business and the location of the devices. For example, businesses that are located in areas with high crime rates or that operate in industries with a high risk of accidents, such as construction or manufacturing, may be more likely to experience loss or damage to their display devices.

To help prevent loss or damage to display devices, businesses can take a number of steps. For example, they can secure the devices with locks or other physical barriers, such as cabinets or enclosures. They can also invest in insurance to cover the cost of replacement or repair in the event of loss or damage.

Additionally, businesses can consider using technology to monitor and protect their display devices. For example, they can use surveillance cameras to keep an eye on the devices, or they can install security software to track the devices and alert the business if they are moved or tampered with.

In conclusion, businesses that use display devices are at risk of experiencing loss or damage to those devices. This can be a significant issue, as these devices are often expensive and essential to the operation of many businesses. To help prevent loss or damage, businesses can take steps such as securing the devices, investing in device insurance, and using technology to monitor and protect them.